Bitcoin has recovered over 5% during the European session in the last 24 hours, as weaker US inflation figures have increased, triggering a reversal in the crypto market. With renewed optimism about the economy’s future, investors have returned to riskier assets, sending the market price of the largest cryptocurrency by market capitalization to $17,250. The continuing FTX unwinding triggered a price drop on Wednesday, sending it to two-year lows.

Overall, the crypto market cap has recovered, but it is still 1.8% lower than yesterday, and the market cap of DeFi coins has dropped by 5.2%. The day was positive for most of the top 20 cryptocurrencies by market cap, as interest in FTX and inflation appeared to decrease.

The FTT token used by FTX, which has been under fire since it was hoarded by the exchange’s sister company Alameda Research, has recently risen by over 25%, reaching $3.45.

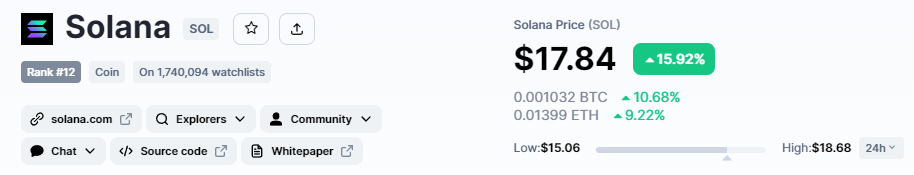

Solana’s SOL has recently increased by more than 16%, despite the fact that it featured prominently on Alameda’s balance sheet, causing investor concern.

US Inflation Falls to January’s Low

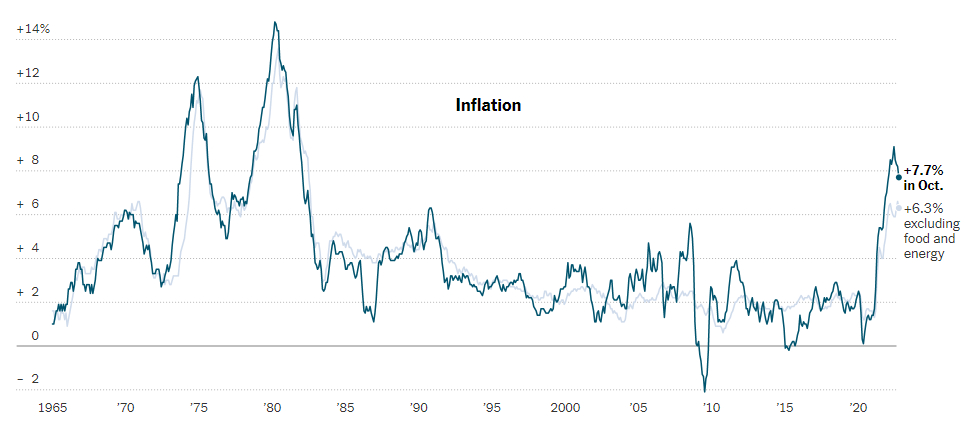

The US Federal Reserve’s recent diet of hawkish, 75 basis point interest rate hikes has been working to reduce a year-long bout of high inflation, as indicated by Thursday’s unexpectedly good Consumer Price Index report, giving investors reason to be optimistic.

As the US inflation rate dipped somewhat in October, investors became more optimistic that the Federal Reserve will raise interest rates less aggressively at their meeting next month.

The annual rate of increase in consumer prices fell to 7.7%, the lowest level since January and below the 8% predicted by experts.

The widely watched “core” measure, which excludes food and energy costs and is seen as the best forecast for inflation’s future direction, decreased from a four-decade high.

The US dollar is weakening as a result of the weaker CPI figures, which is keeping the crypto market bullish today.

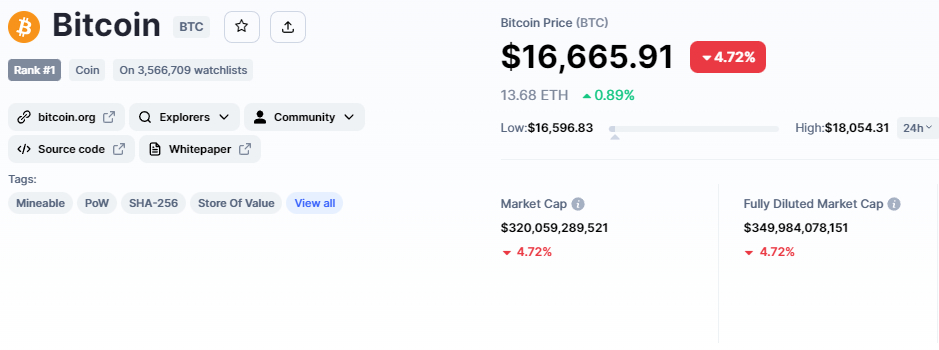

Bitcoin Price Prediction

The current Bitcoin price is $17,183, with a 24-hour trading volume of $62 billion. On November 11, BTC/USD recovered a bit but has given up most of the gains during the European session, and now it’s down over 1.5% in the last 24 hours.

CoinMarketCap currently ranks first, with a live market cap of $330 billion. It has a total supply of 21,000,000 BTC coins and a circulating supply of 19,204,337 BTC coins.

Bitcoin has risen over the $16,000 support level to reclaim the $18,000 level. At the moment, it’s consolidating in a narrow trading range, and a breakout of this will determine further price action.

The BTC/USD pair has already completed a 38.2% Fibonacci retracement at the $18,190 level, and a bullish crossover above this level can expose the BTC price to a 61.8% Fib level of $19,350.

If Bitcoin fails to break over the 38.2% Fibonacci retracement level of $18.250, it may fall back below $15,965.

The MACD, a leading technical indicator, has entered the buying zone, while the 50-day moving average (blue line) and RSI remain in the selling zone. If closing candles fall below $18,000, BTC may continue bearish, with support at $16,000 and 15,850.

A Crypto Pre-Sale With Massive Potential

Dash 2 Trade (D2T)

Dash 2 Trade is an Ethereum-based trading intelligence platform that gives traders of all skill levels real-time statistics and social data, helping them to make better-educated decisions. It started its token sale two weeks ago and has now raised over $8.7 million, while also confirming its first CEX listing on LBank exchange.

1 D2T is currently worth 0.0513 USDT, but this will soon rise to $0.0533 in the next stage of sales and $0.0662 in the final stage.

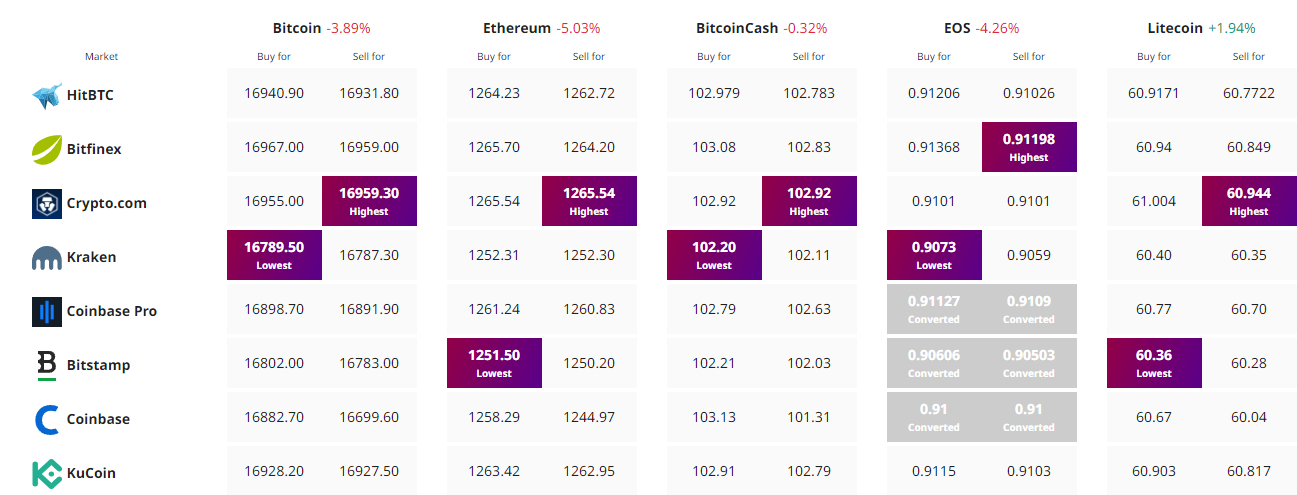

Find The Best Price to Buy/Sell Cryptocurrency